401k calculator 2021

If you make 202120 a year living in the region of New York USA you will be taxed 54786. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Solo 401k Contribution Limits And Types

Ad TD Ameritrade is Here to Help You Plan for the Future.

. The AARP Retirement Calculator will help you find the best amount to save to reach your goal. Our calculators tools will help you take the guesswork out of saving for retirement and assist in building an income strategy to meet your needs. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

Ad It Is Easy To Get Started. A Solo 401 k. Enter your name age and income and then click Calculate The.

Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. First all contributions and earnings to your 401 k are tax deferred. Your average tax rate is 2053 and your marginal tax.

Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Created with Highcharts 822 Year Income Spending Adjusted for Inflation Projected Return on Investment Total Retirement Income 2021 2023 2025 2027 2029 2031 2033 2035 2037 2039 2041 2043 2045 2047 2049 2051 2053 2055 2057 2059 2061 2063 2065.

Our retirement calculator predicts how much you need to retire based on your current salary and investment dollars and divides it by. A 401 k can be one of your best tools for creating a secure retirement. A Retirement Calculator To Help You Plan For The Future.

New York Income Tax Calculator 2021. It provides you with two important advantages. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and.

We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and. Find a Local TD Ameritrade Branch. Use our retirement calculator to determine if you will have enough money to enjoy a happy and secure retirement.

Your employer needs to offer a 401k plan. Protect Yourself From Inflation. Plus many employers provide matching contributions.

IRA and Roth IRA. A 401 k can be one of your best tools for creating a secure retirement. Retirement Calculators and tools.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Youll be taking advantage of dollar-cost averaging tax-deferred growth and a possible company. Traditional 401 k and your Paycheck.

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Please visit our 401K Calculator for more information about 401ks. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of. You may find that your employer matches or makes part of your contributions. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

NerdWallets 401 k retirement calculator estimates what your 401 k. We Have a Variety of Retirement Plans to Help You Plan for the Future. This is the best retirement calculator on the Web.

Roth 401 k contributions allow. A 457 plan is offered to government workers. A 401k is a retirement plan offered by a private-sector employer.

As of January 2006 there is a new type of 401 k contribution. Model multiple post-retirement income streams. A 401 k can be an effective retirement tool.

Schwab Can Help You Make A Smooth Job Transition. Simplify Your 401k Rollover Decision. Solo 401k Contribution Calculator.

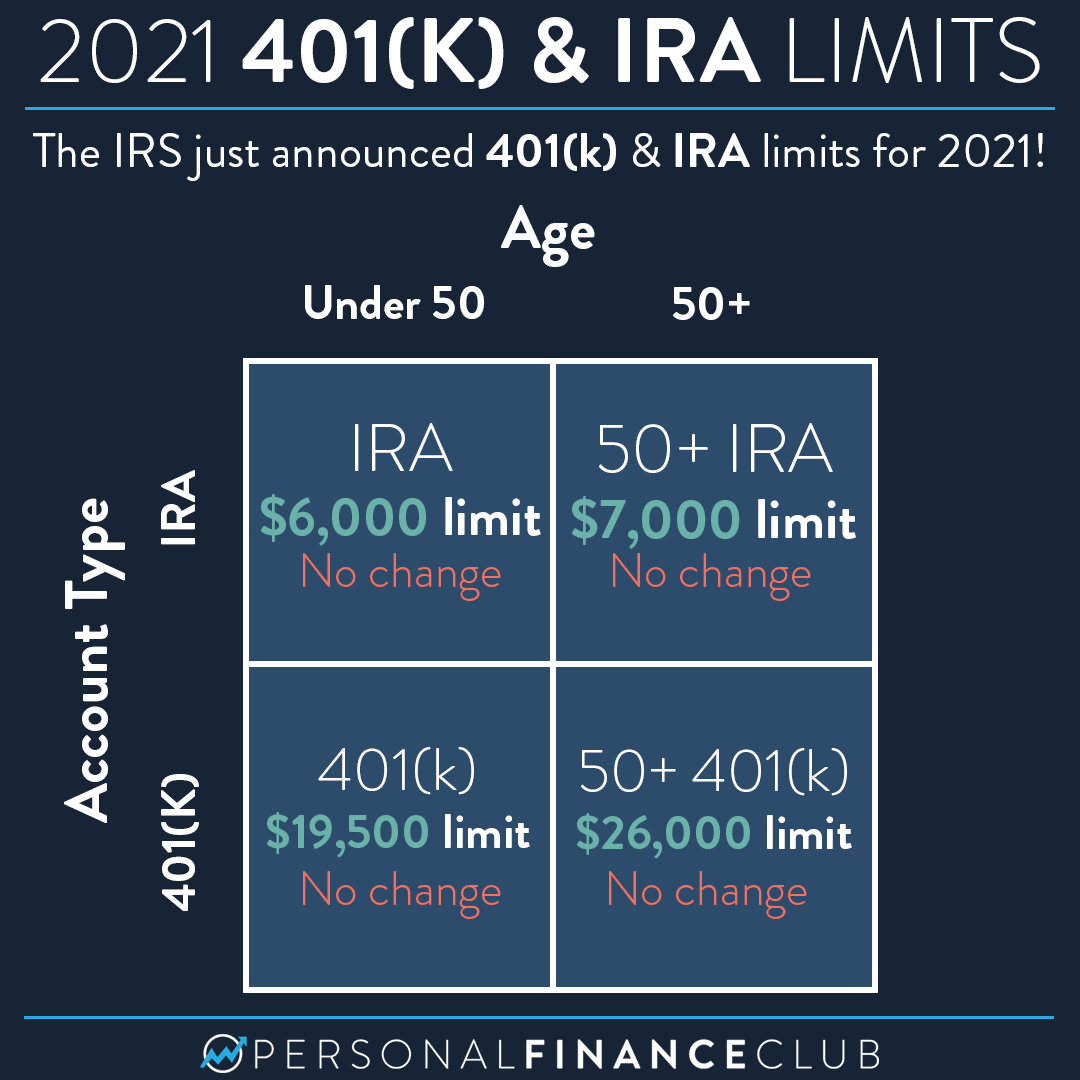

The limits for 2020 and 2021 set by the IRS are 19500 for a 401K plan. Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement.

Schwab Has 247 Professional Guidance. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace 401k is one of the best investment decisions you can make. The contribution limit for 2022 is 20500.

The equivalent for teachers and some non-profit employees is the 403b. Use this calculator to estimate how much in taxes you could owe if. You only pay taxes on contributions and earnings when the money is withdrawn.

How Our Retirement Calculator Works. Your 401k plan account might be your best tool for creating a secure retirement.

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Roth Vs Traditional 401k Calculator Pensionmark

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

401k Contribution Calculator Step By Step Guide With Examples

401k Employee Contribution Calculator Soothsawyer

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Employer 401 K Maximum Contribution Limit 2021 38 500

401k Calculator

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Compound Interest Calculator For Excel

Paycheck Calculator Take Home Pay Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Employee Contribution Calculator Soothsawyer

Free 401k Calculator For Excel Calculate Your 401k Savings

How Much Can I Contribute To My Self Employed 401k Plan

-savings-calculator_lg.png)

401 K Savings Calculator Lg Png